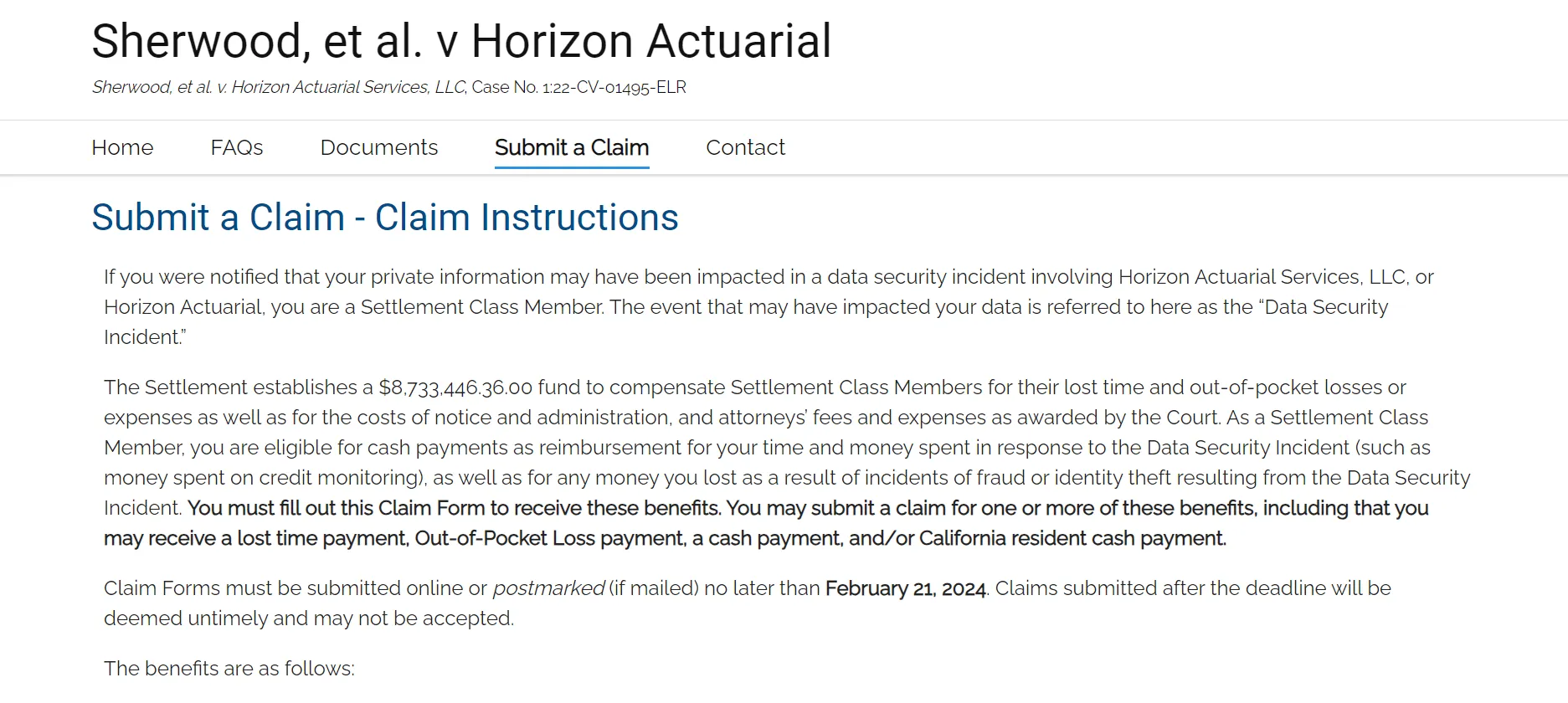

In recent news, the Horizon Actuarial Settlement has fallen prey to a significant data breach, exposing sensitive information of its clients. This breach has raised concerns about the security and integrity of personal data in an era where privacy is highly valued.

The scope and impact of this breach have yet to be fully understood, but it is crucial to take immediate action to protect oneself from potential identity theft.

This introduction aims to provide an overview of the Horizon Actuarial Settlement scam and the subsequent data breach, shedding light on the methods employed by the perpetrators and the steps taken by the company to address the issue.

Additionally, legal ramifications and potential actions that can be pursued will be discussed, along with lessons learned and future preventive measures.

Background on Horizon Actuarial Settlement

The Horizon Actuarial Settlement, a legal agreement currently under discussion, has recently been plagued by a data breach.

To fully understand the implications of this breach, it is important to delve into the background of the Horizon Actuarial Settlement.

The history of this settlement dates back several years, with ongoing fraud investigations. These investigations aim to uncover any fraudulent activities that may have occurred within the settlement, ensuring transparency and justice for all parties involved.

Scope and Impact of the Data Breach

The data breach associated with the Horizon Actuarial Settlement has unravelled a wide-ranging and profound impact on the involved parties and their sensitive information. The breach investigation has revealed the following:

- Extensive compromise of personal and financial data, including social security numbers, bank account details, and confidential settlement information.

- Increased risk of identity theft and financial fraud for affected individuals.

- Potential reputational damage for the Horizon Actuarial Settlement due to their failure to safeguard sensitive data.

- Legal and regulatory consequences, including potential fines and lawsuits, as a result of the breach.

Methods Used in the Breach

The breach at Horizon Actuarial Settlement involved several sophisticated methods used by the attackers.

Firstly, they employed phishing techniques to trick employees into revealing their login credentials.

Secondly, the attackers exploited software vulnerabilities within the company’s systems, gaining unauthorized access and bypassing security measures.

Lastly, social engineering tactics were employed to manipulate employees into providing sensitive information or granting access to critical systems.

These methods allowed the attackers to infiltrate the company’s network and carry out the data breach.

Phishing Techniques Used

Phishing techniques employed in the Horizon Actuarial Settlement scam data breach included sophisticated email spoofing and deceptive website replication.

The cybercriminals utilized these methods to trick unsuspecting victims into divulging sensitive information, such as login credentials and personal data.

The phishing scams involved sending fraudulent emails that appeared to be from legitimate sources, enticing recipients to click on malicious links or enter their confidential details on fake websites.

This breach highlights the importance of robust email security measures to protect individuals and organizations from falling victim to such fraudulent schemes.

Phishing Techniques Used:

- Email spoofing: Cybercriminals impersonated trusted entities or individuals to deceive recipients into believing the emails were legitimate.

- Spoofed email addresses: Attackers manipulated email headers to make it appear as if the messages were sent from a reputable source.

- Impersonation of trusted entities: Scammers imitated well-known companies or organizations to gain the trust of recipients.

- Deceptive website replication: The attackers created fake websites that closely resembled legitimate ones, aiming to trick users into entering their sensitive information.

- URL manipulation: By altering the website’s URL slightly or using domain names similar to the original, the scammers attempted to deceive users into thinking they were on a legitimate site.

- Visual mimicry: The fraudulent websites were designed to look identical to the real ones, including logos, branding, and layout, to deceive users into believing they were interacting with a genuine platform.

Exploiting Software Vulnerabilities

One method employed in the Horizon Actuarial Settlement scam data breach involved exploiting software vulnerabilities. Cybercriminals took advantage of weaknesses in the software systems to gain unauthorized access to sensitive information. Exploiting these vulnerabilities allowed them to bypass security measures put in place to protect the data.

To prevent such breaches, organizations must implement robust cybersecurity measures, including regular software updates and patches, to address any identified vulnerabilities and protect against potential attacks.

Social Engineering Tactics Employed

How did cybercriminals manipulate individuals to gain unauthorized access to sensitive information in the Horizon Actuarial Settlement scam data breach?

The social engineering tactics employed in this breach were designed to exploit human vulnerabilities. The cybercriminals used psychological manipulation and deception to trick individuals into divulging confidential information. These tactics included impersonating trusted entities, such as company representatives or IT support personnel, and using phishing emails or phone calls to deceive victims.

Prevention measures against social engineering tactics include employee awareness training, multi-factor authentication, and implementing robust security protocols.

Identification of the Perpetrators

Identifying the perpetrators of the Horizon Actuarial Settlement scam and the data breach is crucial in ensuring justice is served and preventing future incidents.

Investigators will need to employ various techniques, such as forensic analysis and digital surveillance, to catch the culprits behind this breach.

Uncovering the responsible parties will require a meticulous investigation to trace the origins of the attack and determine who was involved in carrying out this fraudulent scheme.

Catching the Culprits

Authorities are diligently working to apprehend the perpetrators behind the Horizon Actuarial Settlement Scam, employing sophisticated investigative techniques to swiftly identify and bring them to justice.

In the pursuit of catching the criminals, law enforcement agencies are actively tracking the cyberattackers responsible for the breach. They are leveraging advanced digital forensics tools and collaborating with international cybersecurity organizations to trace the origins of the attack and gather evidence.

Additionally, they are closely monitoring online forums and dark web marketplaces for any potential leads or discussions related to the scam.

Investigating the Data Breach

Law enforcement agencies are actively working to identify and apprehend the individuals responsible for the data breach in the Horizon Actuarial Settlement Scam.

The investigation into the breach involves a meticulous data breach analysis, which includes examining digital footprints, tracing IP addresses, and analyzing network traffic.

Law enforcement agencies are collaborating with cybersecurity experts and forensic investigators to gather evidence and establish a chain of custody.

Through this comprehensive investigation, they aim to uncover the identities of the perpetrators and bring them to justice.

Uncovering the Responsible Parties

As the investigation into the Horizon Actuarial Settlement Scam data breach intensifies, efforts are now focused on uncovering the responsible parties behind this cybercrime. The identification of the culprits is crucial for holding them accountable and preventing future incidents.

To achieve this, investigators are employing various techniques, including:

- Forensic analysis of digital evidence to trace the origin of the breach.

- Collaboration with law enforcement agencies and cybersecurity experts to gather intelligence and track down the perpetrators.

Response and Actions Taken by Horizon Actuarial Settlement

The company promptly responded to the data breach by implementing a comprehensive plan to address the issue and protect affected individuals.

Horizon Actuarial Settlement executed response strategies that included conducting a thorough investigation to determine the extent of the breach, identifying the responsible parties, and taking immediate steps to mitigate further damage.

Additionally, the company developed a robust communication plan to inform affected individuals about the breach, provide guidance on protecting their personal information, and offer assistance in case of identity theft.

Steps to Protect Yourself From Identity Theft

Implementing proactive measures is crucial in safeguarding your personal information from identity theft in the wake of the Horizon Actuarial Settlement data breach. To protect yourself, consider the following steps:

- Online Shopping Safety

- Be cautious when sharing personal information online.

- Use secure websites and payment methods to ensure the safety of your transactions.

- Credit Monitoring Services

- Enroll in credit monitoring services to receive alerts about any suspicious activities.

- Regularly review your credit reports to identify any unauthorized accounts or inquiries.

Legal Ramifications and Potential Legal Actions

In light of the Horizon Actuarial Settlement data breach, individuals affected may face potential legal actions and the accompanying legal ramifications.

The breach of personal and sensitive information can lead to severe consequences for both the victims and the responsible parties. Victims may pursue legal actions such as filing lawsuits against the company for negligence, seeking compensation for damages, or joining class-action lawsuits.

The legal consequences of the breach can include financial penalties, reputational damage, and potential criminal charges.

Lessons Learned and Future Preventive Measures

To mitigate future data breaches, it is essential to prioritize cybersecurity measures and implement comprehensive preventive strategies. This requires a multi-faceted approach that includes the following:

- Strengthening network security by regularly updating software, firewalls, and encryption protocols.

- Conducting regular vulnerability assessments and penetration testing to identify and address potential weaknesses.

- Implementing strong access controls, including multifactor authentication and least privilege principles.

- Educating employees about the importance of cybersecurity and providing ongoing training to enhance their awareness and skills in identifying and responding to potential threats.